market funding.

market funding.

market funding.

Business Planning

We develop the relationships that underpin the next phase in your organisation’s growth. We do this by discerning the people.

Program management

The development of your next business plan will be executed by a brilliant team who will indicate your grand success.

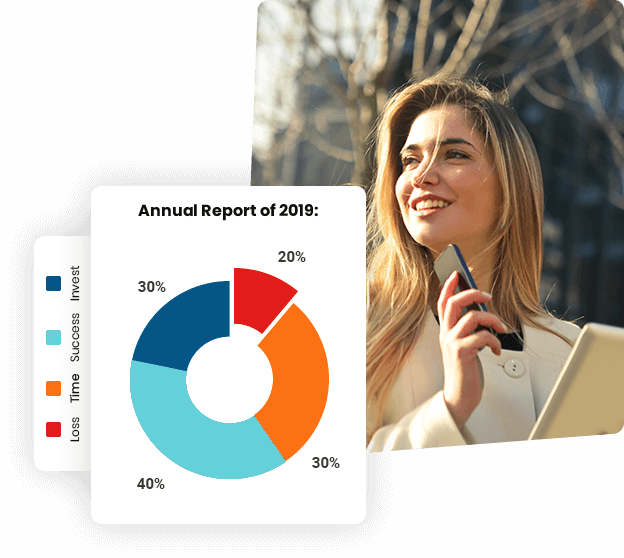

Chart management

Graphic design is the process of visual and problem-solving using one or more of typography, photography and illustration.

SEO Optimization

A blueprint for accomplishing your objectives, from thought leadership to capacity building, photography and illustration.

Market Research

Photography is the core of everything we do, photography equipment, camera, photography and reviews, photography articles.

You can also find our Consultant Service to contact for the consulting

We’re a global stakeholder relations and partnership building consultancy.

Collaborate Consulting exists to find the place where to being seemingly disparate interests meet. From that point of the connection, we create platforms.

Strategic vision

A client once told us that where the others focus on one star one issue we see the whole sky.

Interpersonal skills

Forging relationships between

multi-national corporations, govern ments and global NGOs begins with connections between people.

Networks that span sectors

Over more than 20 years, we’ve

fostered trusted relationships across government, industry and global forums.

Flexible delivery model

We adapt our delivery to the way your work, whether as an external provider or by providing senior.

We position our clients at the forefront of their field by advancing an agenda.

We bring more than 20 years’ senior experience forging

collaborations across government, private sector and

international forums.

Trademark Opposition

A feature of great leaders is that they never stop for learning. Mentorship and Coaching for your leaders.

Trademark Hearing

When there is a key element of your organisation that is limiting your people’s to engagement performance.

Trademark registration

Whatever the scenario, we tap into deep networks and innate understanding of each party’s priorities.

We draw on our global network to assemble with the skills of task at hand.

We have spent 25 years working for one of Australia’s most

recognised and successful retailers purpose and inspired culture, where people work cohesively towards shared goals.

50%

Active to work

We do not believe in contracts

therefore we do not have one.

We are fully invested.

75%

Completed work

You will be fully satisfied, you

are under no obligation to continue with the services I provide.

To review means to look back over something for evaluation or memory.

It’s always a joy to hear that the work I do has positively

impacted our clients and that they are happy to share their

experience.

“

“

“

“

I had the pleasure of working with Consultio as part of a 6 month ‘Regional Retail Leadership Program’. Her passion for leadership development is evident to help others.

Maria Silverii

CEO of Blue Illusion

I had the pleasure of working with Consultio as part of a 6 month ‘Regional Retail Leadership Program’. Her passion for leadership development is evident to help others.

Kathleen Smith

Senior Director

I had the pleasure of working with Consultio as part of a 6 month ‘Regional Retail Leadership Program’. Her passion for leadership development is evident to help others.

Pamela Johnson

Leadership Group

I had the pleasure of working with Consultio as part of a 6 month ‘Regional Retail Leadership Program’. Her passion for leadership development is evident to help others.

Macquarie Telecom

Senior Director

You can learn more from our asked questions

Lorem ipsum dolor sit amet consecte tur adipiscing elit sed do eiusmod tempor incididunt ut labore.

Lorem ipsum dolor sit amet consecte tur adipiscing elit sed do eiusmod tempor incididunt ut labore.

Lorem ipsum dolor sit amet consecte tur adipiscing elit sed do eiusmod tempor incididunt ut labore.

Lorem ipsum dolor sit amet consecte tur adipiscing elit sed do eiusmod tempor incididunt ut labore.

Get a free quote here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Many organizations realize the benefits of forming work teams.

Employees need to realize the importance of working well with their teammates when coming into a new job or an existing one. A team player is more valuable.

Our client, global analytical techno company, wanted to build market.

In this context, our approach was to build trusted and strategic relationships within key sectors, with the goal of advancing health, trade and business outcomes.

All

Coaching

Facilitation

Stakeholder relations

Strategy

Load more

Get in touch for any kind of help and informations

We’re glad to discuss your organisation’s situation. So please contact us via the details below, or enter your request.

Our head office address:

3556 Hartford Way Vlg, Mount Pleasant, SC, 29466, Australia.

Call for help:

(734) 697-2907

(843) 971-1906

(843) 971-1906

Mail us for information

noreply@envato.com

noreply@consultio.com

noreply@consultio.com

We’re here to share story & more news from resource library.

We would love to share a similar experience and how I

learned some valuable lessons during a downturn.